3 Good Buying Opportunities in the Oil & Gas Drilling Industry

The Zacks Oil and Gas - Drilling industry appears on track to achieve substantial gains as energy investment ticks up and North American activity continues to move steadily higher. Building on this bullish narrative, firms like Helmerich & Payne HP, Patterson-UTI Energy PTEN and Precision Drilling PDS have room for upside and are likely to see impressive revenue and cash flow growth. With strict cost control and by optimizing operational leverage in a growth environment, these stocks are good investment opportunities.

Industry Overview

The Zacks Oil and Gas - Drilling industry consists of companies that provide rigs (or specialized vehicles) on a contractual basis to explore and develop oil and gas. These operators offer drilling rigs (both land-based/onshore and offshore), equipment, services and manpower to exploration and production companies worldwide. Drilling for hydrocarbons is quite costly and technically difficult, the future of which primarily depends on contracting activity and the total number of available rigs at a given point of time, rather than the price of oil or gas. Within the industry, it's interesting to note that the volatility associated with offshore drilling companies is much higher than their onshore counterparts and their share prices are more correlated to the price of oil. Overall, the drilling stocks are among the most volatile in the entire equity market.

3 Trends Defining the Oil and Gas - Drilling Industry's Future

Higher Number of Rigs: Oil and natural gas prices have rebounded sharply, revisiting their multi-year highs earlier this year due to rising demand and geopolitical tensions surrounding the Russian invasion of Ukraine. Consequently, drilling activity has been picking up in North America, a region on which most drillers are highly dependent. As a matter of fact, the rig count in early December was 982 compared with 753 a year ago, in sync with the strength in commodity prices. The number of active units in the international market has gained sharply too. The steady growth in rig count is an encouraging indicator of drilling activity.

Low Replenishment of Reserves Point to Drilling Requirement: One of the key positive arguments for drillers is the focus on the reserve replacement rate. Over the past few years, the supermajors have struggled to replace all of the oil and gas they churn out, raising concerns about future production. In this context, Chevron’s 10-year reserve replacement ratio of 100% indicates the inability to add proved reserves to the amount of oil and gas produced. This clearly calls for a calibrated approach in meeting reserve shortfalls in the long run. Consequently, a gradual improvement in drilling activity looks likely.

Dwindling Pool of Legacy, High-Margin Contracts: For most operators, order levels have remained depressed, and day rates are trending just above cash costs despite the strong rebound in commodity prices. This has put increasing pressure on their revenue-generating capacity. Further, as the companies’ legacy, high-margin contracts wind down slowly, the drillers are faced with the prospect of a drop in backlog (and consequently, revenues), which is likely to accelerate over the next few quarters. This also leaves the drillers vulnerable to addressing their massive debt maturities and investment in newbuilds.

Zacks Industry Rank Indicates Positive Outlook

The Zacks Oil and Gas - Drilling industry is an 8-stock group within the broader Zacks Oil - Energy sector. It currently carries a Zacks Industry Rank #19, which places it in the top 8% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates upbeat near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the top 50% of the Zacks-ranked industries is a result of a conducive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential. While the industry’s earnings estimates for 2022 have improved 53.8% in the past year, the same for 2023 have risen 322.4% over the same timeframe.

Considering the encouraging dynamics of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

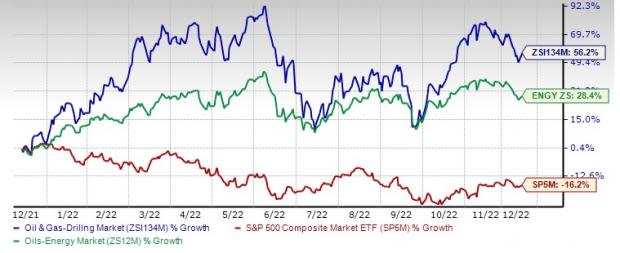

Industry Outperforms Sector & S&P 500

The Zacks Oil and Gas - Drilling industry has fared better than the broader Zacks Oil - Energy Sector as well as the Zacks S&P 500 composite over the past year.

The industry has surged 56.2% over this period compared with the broader sector’s increase of 28.4%. Meanwhile, the S&P 500 has lost 16.2%.

One-Year Price Performance

Industry's Current Valuation

Since oil and gas drilling companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of non-cash expenses.

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA), the industry is currently trading at 13.52X, higher than the S&P 500’s 12.08X. It is also well above the sector’s trailing-12-month EV/EBITDA of 3.21X.

Over the past five years, the industry has traded as high as 24.76X, as low as 7.28X, with a median of 12.03X, as the chart below shows.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio (Past Five Years)

3 Oil and Gas - Drilling Stocks to Buy Now

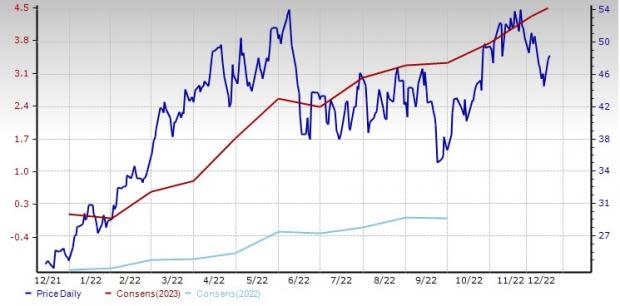

Helmerich & Payne: Helmerich & Payne is engaged in the contract drilling of oil and gas wells in the United States & internationally. Its technologically advanced FlexRigs are much in demand. The company has already upgraded most of its drilling fleet with the latest technology. Besides, Helmerich & Payne boasts a strong balance sheet, carrying $542.6 million in long-term debt, with a debt-to-capitalization of just 16.4% compared with many of its peers that are hugely burdened with debts, accounting for around 50% of their total capital structure. With available liquidity surpassing debt levels and a lack of significant near-term maturities, Helmerich & Payne should sail through any difficult operating environment.

The fiscal 2023 Zacks Consensus Estimate for this Tulsa, OK-based company indicates 4,360% earnings per share growth over fiscal 2022. The provider of land and offshore rigs carries a Zacks Rank #1 (Strong Buy) and its shares are up 104.9% in a year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: HP

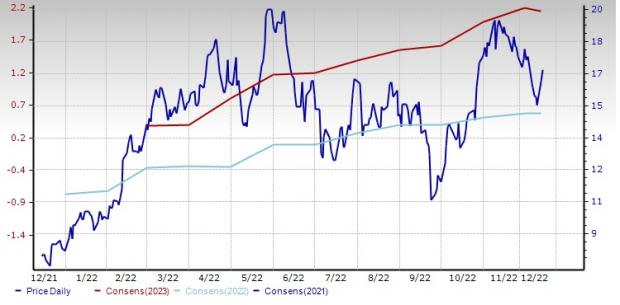

Patterson-UTI Energy: Patterson-UTI Energy is one of the largest North American land drilling contractors, having a large, high-quality fleet of drilling rigs. The company’s technologically advanced Apex rigs are the key to its success. PTEN’s proprietary design makes the rigs move faster than the conventional rigs, and drill quicker and more efficiently. Patterson-UTI’s acquisition of Pioneer Energy Services has boosted its scale and geographic presence. Following the transaction closure, Patterson-UTI possesses 166 super-spec rigs in the United States, with nearly 50% outfitted with alternative power sources to minimize emissions. In addition, this takeover expands Patterson-UTI’s geographic reach to foreign markets with the addition of eight rigs in Colombia, where Pioneer has served for the past 14 years with a well-recognized operations staff and setup.

The 2022 Zacks Consensus Estimate for this Houston, TX-based company indicates 128.5% earnings per share growth over 2021. PTEN currently carries a Zacks Rank of 1. The stock has gained 104.7% in a year.

Price and Consensus: PTEN

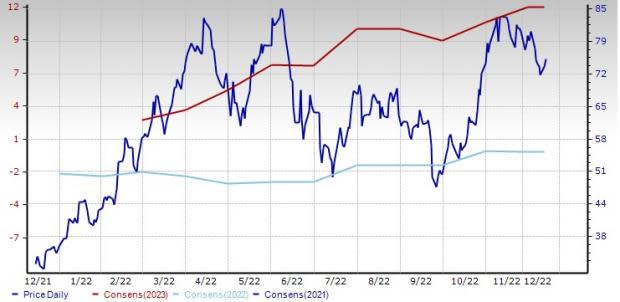

Precision Drilling: This company — Canada’s largest drilling rig contractor — has a Zacks Rank #2 (Buy). A provider of rentals, wellsite accommodations/catering and snubbing services, Calgary-headquartered Precision Drilling has active operations in the U.S., Mexico and Saudi Arabia. In particular, PDS’ market-leading Alpha digital technology portfolio provides it with a competitive edge. A tight rig market, together with strength in the company’s activity levels should result in gigher dayrates and an improving contract book. Precision Drilling’s prudent cost management and technological leadership are its other growth drivers.

The 2022 Zacks Consensus Estimate for PDS indicates 100.8% earnings per share growth over 2021. Over the past 60 days, the Zacks Consensus Estimate for 2022 has moved up 107.8%. Precision Drilling stock has gained 124.4% in a year.

Price and Consensus: PDS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helmerich & Payne, Inc. (HP) : Free Stock Analysis Report

PattersonUTI Energy, Inc. (PTEN) : Free Stock Analysis Report

Precision Drilling Corporation (PDS) : Free Stock Analysis Report